- Introduction

- 🧠 What Happens in Their Mind

- 💔 The Cost of Borrowing

- 🛡️ How to Deal With Them (Without Losing Yourself)

- 🌱 How to Truly Help Them Long-Term

- 📝 Key Takeaway

Introduction

Someone asks to borrow money from you. Usually, you don’t even ask for what reason. Sometimes they offer one: “I’ll pay you back when I get my salary.” You feel guilty. Guilty if you don’t help, guilty if you turn them down — because you remember moments when you needed help too.

So you give.

But “later” becomes “never.” And the next month, the same person is back again, asking for more. The old debt is left untouched.

They’re smart too. They ask for small amounts — RM20 ($5), RM50 ($12) — just enough to make it feel awkward for you to chase them. Over the years, the small amounts pile up, and you realize you’ve become their personal ATM.

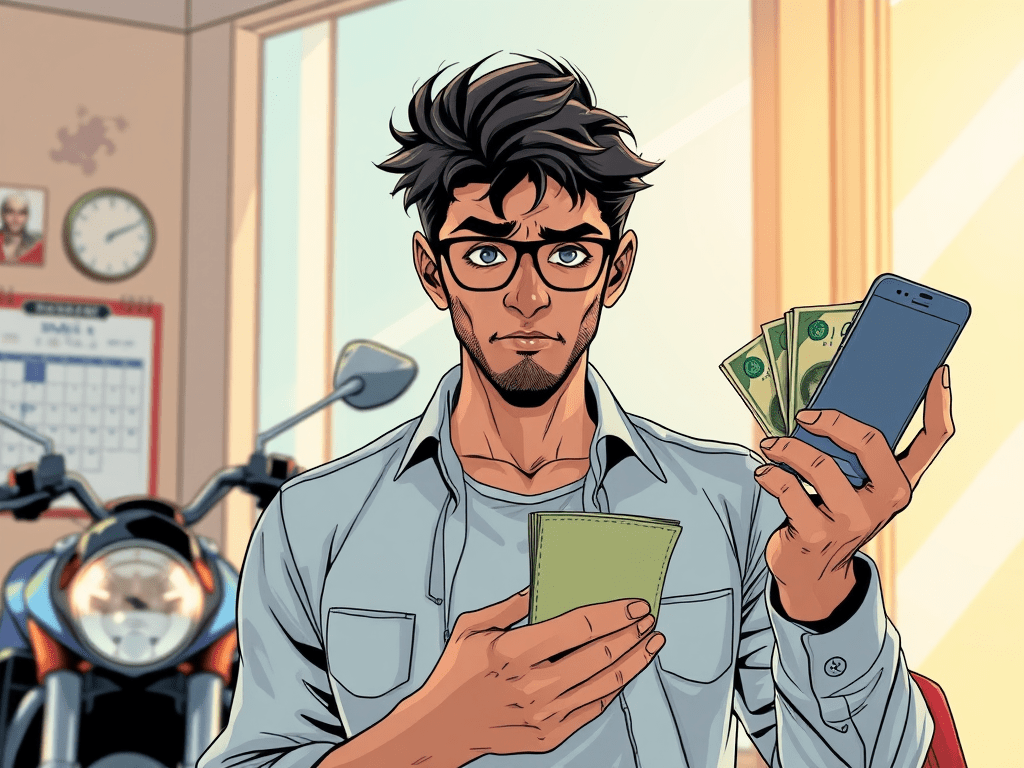

One day, you see them with a new motorcycle. Or posting Starbucks on Facebook. Or showing off the latest iPhone. And suddenly, you feel like the stupid one.

It leaves you puzzled:

“If they’re not truly broke, why keep borrowing?”

The answer is deeper than money. It’s about psychology, habits, and identity.

🧠 What Happens in Their Mind

When these people borrow, they’re not really thinking about repayment. Their brains are locked into short-term relief, not long-term consequences.

Denial of Consequences

Their mind says: “I’ll deal with paying back later.” Psychologists call this temporal discounting — future pain feels less real than today’s relief. And often, the “future pain” never comes, because they only borrow from people who never push them to repay.

Victim Identity

They present themselves as struggling: complaining about money, talking about long hours at work, exaggerating hardship. This performance builds sympathy and opens doors.

Entitlement Bias

Deep down, some believe: “Others have more than me. It’s only fair they share.” It becomes an unspoken justification to borrow without guilt.

Borrowing Addiction

Borrowing itself becomes a habit loop. Ask → get → relief. That relief releases dopamine, the same chemical linked to addictions. Over time, the act of borrowing is no longer just about survival — it’s about chasing that hit of instant relief.

Social Shielding

Borrowing allows them to live a double life. Around lenders, they wear the mask of hardship. But on social media, or with other friends, they show off: new bike, branded drink, Apple Watch. Borrowing funds the illusion of stability.

💔 The Cost of Borrowing

We often forget: borrowing is not just financial. It’s a trust contract.

When someone doesn’t pay back, they’re not only breaking financial promises — they’re breaking social trust. But, do they actually care about us, the borrower?

In the Moment: No, They Don’t

When they borrow, their brain is focused on relief now. The trust contract you value isn’t at the front of their mind. This is short-term bias in action:

They think: “I need cash now, I’ll figure the rest later.”

Social consequences feel distant, blurry, almost unreal.

So at the time of borrowing, they genuinely don’t feel the weight of trust being broken.

Subconscious Justifications

To silence guilt, many build their own excuses:

“It’s just a small amount, they won’t miss it.”

“Others are better off than me anyway.”

This is called cognitive dissonance reduction — the mind bends reality so they can keep doing what they do without feeling like a “bad person.”

Selective Caring

Here’s the twist: They do care about social trust — but only in certain spaces.

They care about looking good on Facebook (hence the Starbucks and iPhone posts).

They care about keeping their reputation with peers they admire.

But they don’t care as much with “safe lenders” — the people they know won’t confront them.

In other words: they gamble with relationships they think they can afford to lose.

When the Social Circle Closes

Over time, when neighbors stop opening their doors, friends pull away, and family avoids eye contact, reality does hit. Some spiral further (to loan sharks), others finally feel shame.

At that point, yes — they feel the cost of broken trust. But by then, much of the damage is already done.

🛡️ How to Deal With Them (Without Losing Yourself)

1. Set Your Boundaries

Be kind, but clear.

“I care about you, but I don’t lend money anymore. It’s just my principle.”

This way, they know it’s about your rule, not a personal rejection.

2. Help in Other Ways

If you want to support, give food, not cash.

Share budgeting tips, apps, or even small side-income ideas.

This helps them live — without feeding the habit.

3. Write It Down

If you really must lend (like family):

- Get it in writing, even on WhatsApp.

- Agree on a date of repayment.

People are more likely to pay when their promise is recorded.

4. Don’t Carry It Alone

If they owe several people, deal with it together.

A polite group talk often works better than one-on-one nagging.

Peer pressure can turn into accountability.

5. Be Kind, But Firm

Remember, many aren’t just “lazy” — they may struggle with self-control or money management skills. You can show compassion, but protect your own peace first.

🌱 How to Truly Help Them Long-Term

Educate, don’t lecture. Show small, practical steps: saving RM5 a day, delaying one purchase, tracking expenses in a notebook.

Model healthy habits. Let them see you save first before buying. Actions teach better than words.

Point them to support. In Malaysia, Credit Counseling and Debt Management Agency provides debt counseling and repayment programs.

Offer emotional support. Sometimes the borrowing is less about money and more about needing comfort. Be available — but not as their ATM.

📝 Key Takeaway

When people borrow recklessly, it’s rarely about the money. It’s about the relief, the image, the story they tell themselves.

You can help — but only with compassion that has clear boundaries. Otherwise, you risk losing not just your money, but your peace of mind.

You can care for them without being their ATM. Boundaries are love too.

Leave a comment